Cost of Living in Charlotte (2026): The Full Breakdown for New Movers

Charlotte is one of the fastest-growing cities in the Carolinas, and if you're thinking of moving here in 2026, you probably want to know how far your salary goes. The good news? Charlotte's overall cost of living is 1% lower than the national average, with housing costs 15% cheaper than the U.S. average.

But that's just the headline. When you dig into specific neighborhoods, lifestyle choices, and family situations, the numbers tell different stories. This guide breaks down housing costs, utilities, transportation, childcare, groceries, and taxes with a real-estate-driven perspective to help you determine which Charlotte neighborhood fits your budget.

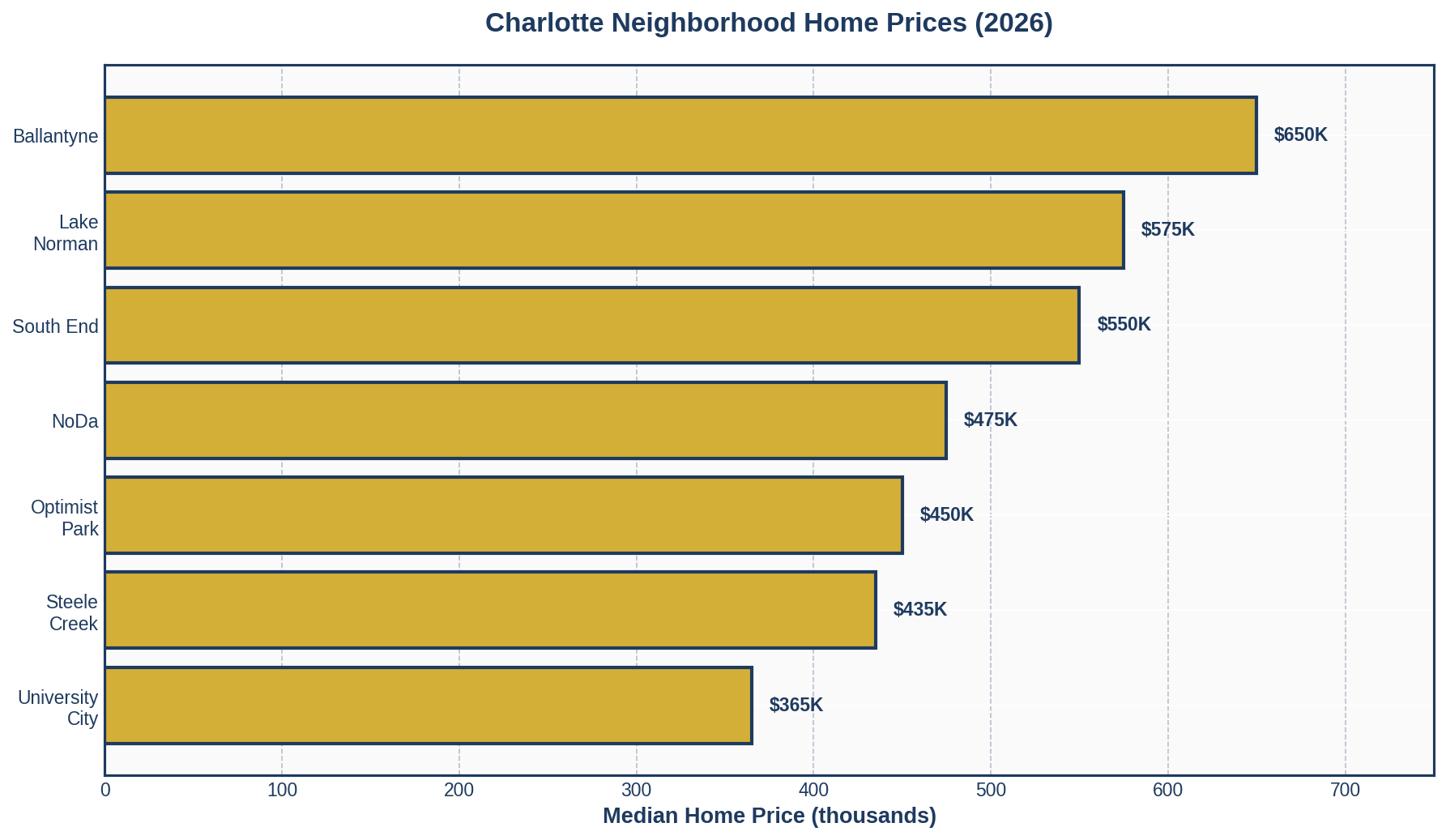

Housing Costs by Region: Where Your Money Goes Furthest

Housing is your biggest expense, and in Charlotte, it varies dramatically by neighborhood. The average monthly rent in Charlotte is $1,653, while home prices circle around $398,825.

Here's what you can expect across Charlotte's major areas:

Uptown Charlotte

- Rent (1BR): $1,800-$2,500/month

- Home prices: $450,000-$800,000+

- Best for: Young professionals who want walkability, nightlife, and a 5-minute commute

South End

- Rent (1BR): $1,700-$2,400/month

- Home prices: $400,000-$700,000

- Best for: Young professionals seeking trendy restaurants, breweries, and light rail access

NoDa (North Davidson)

- Rent (1BR): $1,500-$2,100/month

- Home prices: $350,000-$600,000

- Best for: Arts lovers, creatives, and those wanting urban living with character

Ballantyne

- Rent (1BR): $1,600-$2,200/month

- Home prices: $450,000-$850,000+

- Best for: Families seeking top schools, corporate offices, and suburban amenities

Lake Norman Area

- Rent (1BR): $1,400-$1,900/month

- Home prices: $400,000-$750,000

- Best for: Families wanting waterfront access, good schools, and larger lots

Steele Creek

- Rent (1BR): $1,300-$1,700/month

- Home prices: $320,000-$550,000

- Best for: First-time buyers seeking new construction and affordability

University City

- Rent (1BR): $1,200-$1,600/month

- Home prices: $280,000-$450,000

- Best for: First-time buyers, UNC Charlotte staff/students, and investors

Optimist Park

- Rent (1BR): $1,400-$1,900/month

- Home prices: $350,000-$550,000

- Best for: Young professionals wanting proximity to Uptown with emerging neighborhood vibes

Average Rents + Home Price Ranges

To put this in perspective, here's what different housing budgets get you:

$300,000-$400,000

Entry-level homes in University City, Steele Creek, parts of Concord and Mint Hill. Expect 3-4 bedrooms, 2-3 bathrooms, suburban locations with good access to highways.

$400,000-$600,000

Move-up homes in established neighborhoods like South End (condos/townhomes), NoDa, Optimist Park, or single-family homes in Ballantyne, Lake Norman, or Matthews.

$600,000-$850,000+

Luxury homes in Myers Park, Dilworth, Ballantyne estates, Lake Norman waterfront, or newer construction in premium areas.

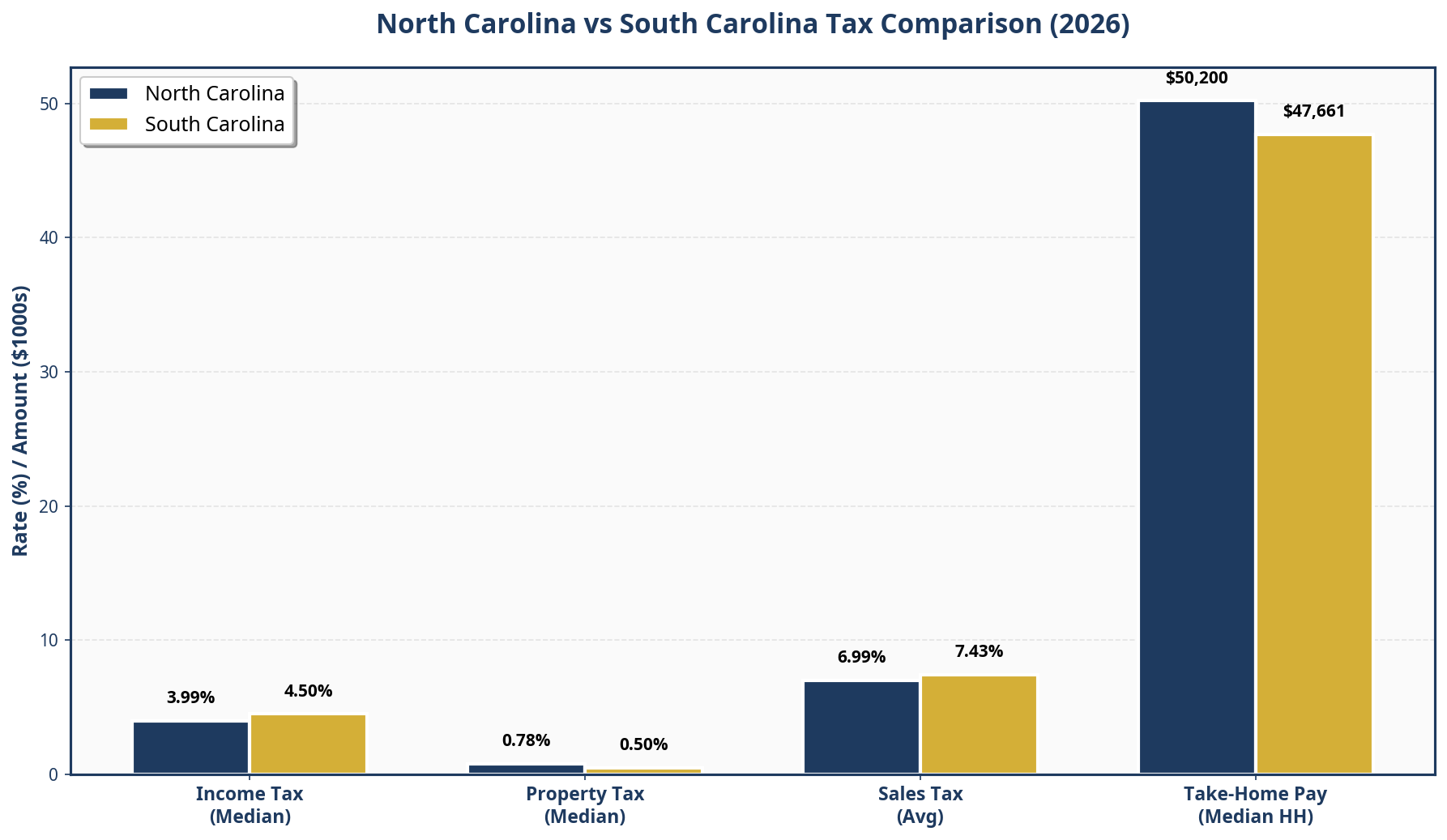

Taxes: North Carolina vs. South Carolina Comparison

One of Charlotte's biggest advantages? North Carolina's competitive tax structure.

North Carolina Tax Rates (2026)

North Carolina's personal income tax rate drops to 3.99% in 2026, making it one of the most competitive states in the Southeast.

- Income Tax: 3.99% flat rate (everyone pays the same percentage)

- Property Tax: 0.78% average (NC ranks 34th nationally)

- Sales Tax: 6.99% combined state/local average

- No Social Security tax

- Most retirement income taxed at the flat rate

South Carolina Tax Rates (2026)

If you're considering Fort Mill, Rock Hill, or other SC border towns:

South Carolina's income tax rate is proposed to drop to 3.99% in 2026, matching North Carolina

- Income Tax: 0-6.5% graduated (lower earners pay less)

- Property Tax: 0.5% average (SC ranks 45th nationally - much lower!)

- Sales Tax: 7.43% combined state/local average

- No Social Security tax

- Additional retirement income exemptions

The Verdict

North Carolina gives you more disposable income overall ($50,200 vs. $47,661 in South Carolina based on median household income after taxes), despite South Carolina's lower property taxes.

Transportation & Commute Costs

Charlotte is largely car-dependent, though some neighborhoods offer alternatives.

Car Ownership Costs

- Gas: $50-$80/month (average commuter)

- Insurance: $120-$180/month

- Maintenance: $100-$150/month average

- Parking: Free in most areas; $100-$200/month in Uptown

Public Transit (LYNX Light Rail + CATS Buses)

- Single ride: $2.20

- Monthly pass: $88

- Coverage: Blue Line runs from UNC Charlotte through Uptown to South End

Average Commute

26 minutes citywide, but living near Uptown, South End, or along the light rail corridor can cut this significantly.

Pro Tip

Test-drive your commute during rush hour (7:30-9 AM and 4:30-6 PM) before choosing a neighborhood. Traffic on I-77, I-85, and I-485 can add 15-30 minutes to your drive.

Childcare & School Options

Childcare is one of Charlotte's most significant family expenses.

Daycare Costs (2026)

- Infant care (full-time, 5 days/week): $2,400-$2,692/month

- Toddler care (full-time, 5 days/week): $500-$800/month

- Preschool (full-time, 5 days/week): $800-$1,500/month

Charlotte-Mecklenburg Schools (CMS)

Public schools are free, with quality varying significantly by neighborhood. Top-rated areas include Ballantyne, Myers Park, and SouthPark zones.

Private Schools

Tuition ranges from $8,000-$30,000+ annually depending on the school. Popular options include Charlotte Latin, Charlotte Country Day, and Providence Day School.

Public Pre-K

Free NC Pre-K program available for eligible 4-year-olds through Charlotte-Mecklenburg Schools.

Utilities: What to Budget Monthly

For a typical 3-bedroom home, expect $250-$300/month in utilities, with a roughly 15% increase June-August due to air conditioning.

Breakdown for a 1,800 sq ft home

- Electricity (Duke Energy): $150-$200/month

- Water/Sewer: $50-$70/month

- Internet (60+ Mbps): $60-$80/month

- Gas (if applicable): $30-$50/month

Basic utilities for an average apartment run around $170/month, making Charlotte competitive with other major metros.

Energy-Saving Tip

Duke Energy offers Time-of-Use rates that can save ~10% if you shift heavy appliance use (dishwasher, laundry) to off-peak hours.

Groceries & Food Costs

Grocery prices in Charlotte are about 1.1% higher than the national average, with a standard grocery basket for one person totaling about $320/month.

For a family of four, budget $800-$1,200/month depending on dietary preferences.

Where to Save

- Harris Teeter: Mid-range, frequent sales with VIC card

- Food Lion: Budget-friendly staples

- Aldi: Best prices on basics

- Trader Joe's: Specialty items at reasonable prices

- Farmers markets: Fresh produce at competitive prices (7th Street Public Market, Charlotte Regional Farmers Market)

Dining Out

- Casual meal: $12-$18 per person

- Mid-range dinner: $25-$45 per person

- Fine dining: $60-$100+ per person

Neighborhood-by-Neighborhood Affordability

Let's break down monthly costs for different Charlotte neighborhoods, assuming a family of two adults working professionals:

Uptown Charlotte (Urban Lifestyle)

- Rent (1BR): $2,000/month OR Mortgage (1BR condo ~$450K): $2,800/month

- Utilities: $150/month

- Groceries: $600/month

- Transportation: $200/month (parking + occasional Uber)

- Entertainment: $400/month

- Total: $3,350 (renting) or $4,150 (owning)

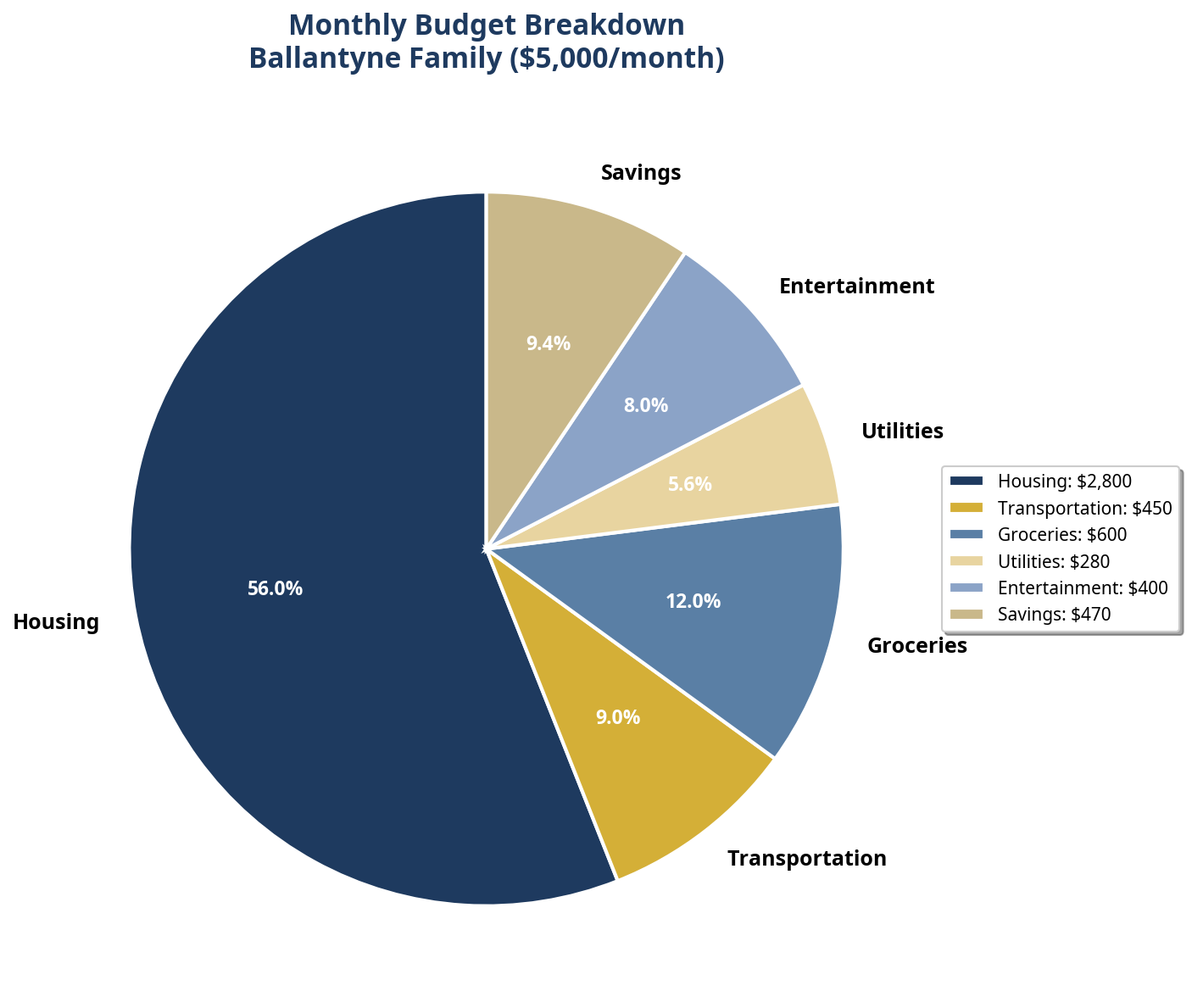

Ballantyne (Family Suburban)

- Rent (3BR): $2,500/month OR Mortgage (3BR ~$550K): $3,500/month

- Utilities: $280/month

- Groceries: $800/month

- Transportation: $450/month (2 cars)

- Entertainment: $400/month

- Childcare (2 kids): $3,000/month

- Total: $7,430 (renting) or $8,430 (owning)

Steele Creek (Affordable Suburban)

- Rent (3BR): $1,700/month OR Mortgage (3BR ~$400K): $2,600/month

- Utilities: $280/month

- Groceries: $700/month

- Transportation: $450/month (2 cars)

- Entertainment: $300/month

- Total: $3,430 (renting) or $4,330 (owning)

Real-World Budget Examples

Let's look at how different income levels live in Charlotte:

Single Professional ($75,000/year)

- Singles earn $75,000-$90,000+

- Can afford $1,800-$2,200/month rent or $400K-$500K home

- Live comfortably in South End, NoDa, or Optimist Park

Couple ($100,000-$130,000/year combined)

- Couples earn $75,000-$90,000+

- Can afford $2,200-$2,800/month rent or $500K-$650K home

- Live comfortably in Ballantyne, Lake Norman, or South End (townhome)

Families ($100,000-$130,000+/year)

- Families earn $100,000-$130,000+

- Need to budget for childcare ($2,000-$4,000/month)

- Best neighborhoods: University City, Steele Creek, parts of Ballantyne

The key is choosing the right neighborhood for your budget and lifestyle. Don't stretch yourself thin trying to afford South End when University City or Steele Creek might offer better value and quality of life.

Ready to Make Your Charlotte Move?

Get instant access to:

- ✅ Neighborhood comparison charts with pricing

- ✅ School ratings by district

- ✅ Cost-of-living calculator customized for Charlotte

- ✅ Mortgage pre-qualification checklist

- ✅ Moving timeline and checklist

- ✅ Insider tips for winning competitive offers

Cost data sourced from Apartments.com, RentCafe, Care.com, North Carolina Department of Revenue, and local Charlotte market reports as of November 2025. Actual costs may vary based on specific circumstances.